Since the inception of the term ‘corporate innovation’, companies have struggled with how to structure it in a way that is both separate enough from their core business to be innovative but still able to take advantage of the resources large companies provide. Other struggles like incentivizing top talent, failure stigma, and involving stakeholders like customers have been problems since the beginning. To solve these issues, companies have developed and continue to experiment with structures like accelerators, corporate venture capital, and innovation labs but the struggle continues.

The rise of web3 has presented a potential new solution to the corporate innovation problem in the form of decentralized autonomous organizations, commonly known as DAOs. To use Linda Xie’s definition, “A decentralized autonomous organization (DAO) is a group organized around a mission that coordinates through a shared set of rules enforced on a blockchain. This article by Packy McCormick gives you a good overview of DAOs and why they’re so powerful. Packy makes one addition to the definition that I think will make the concept click:

“More simply, DAOs are a new way to finance projects, govern communities, and share value. Instead of a top-down hierarchical structure, they use Web3 technology and rapidly evolving governance and incentive systems to distribute decision-making authority and financial rewards. Typically, they do that by issuing tokens based on participation, contribution, and investment. Token holders then have the ability to submit proposals, vote, and share in the upside.”

In this article, I’ll explore how a corporate innovation DAO could be structured and what it solves. To make the discussion more straightforward, let’s assume the DAO is composed of stakeholders including the parent company, the innovation team and internal employees, loyal customers, and fans of the brand. These stakeholders all hold tokens in the DAO and the value of those tokens increase if the DAO is creating value or there is some other social benefit that comes with being part of it.

How Would A Corporate Innovation DAO Be Structured?

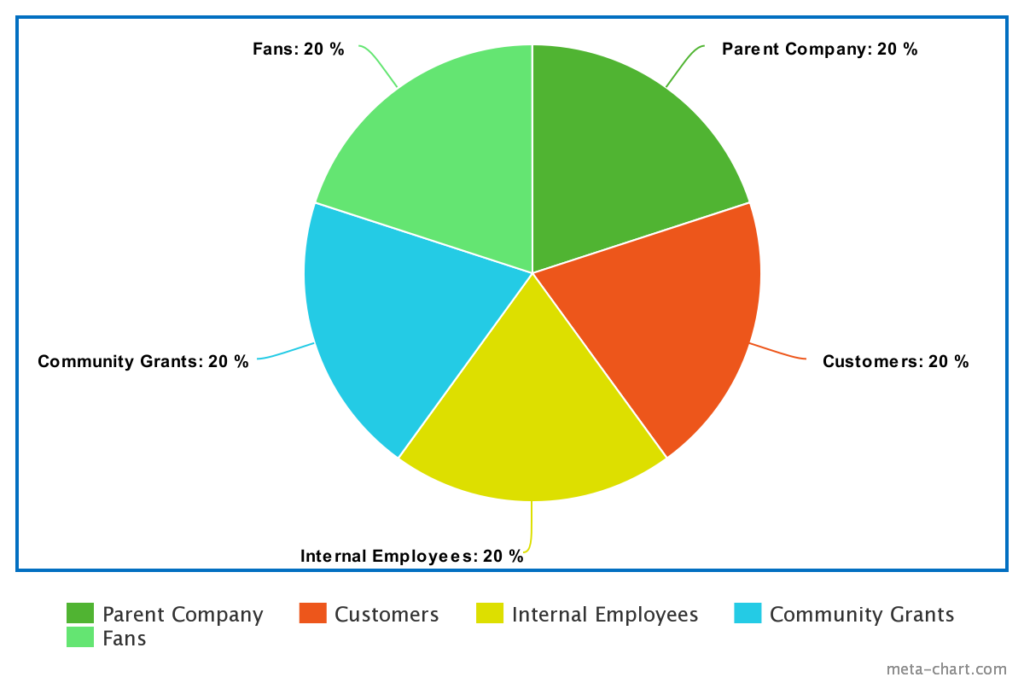

While I’m certainly not an expert on DAOs, one idea for a corporate innovation DAO structure would be an even token split across the different stakeholders. Something like this:

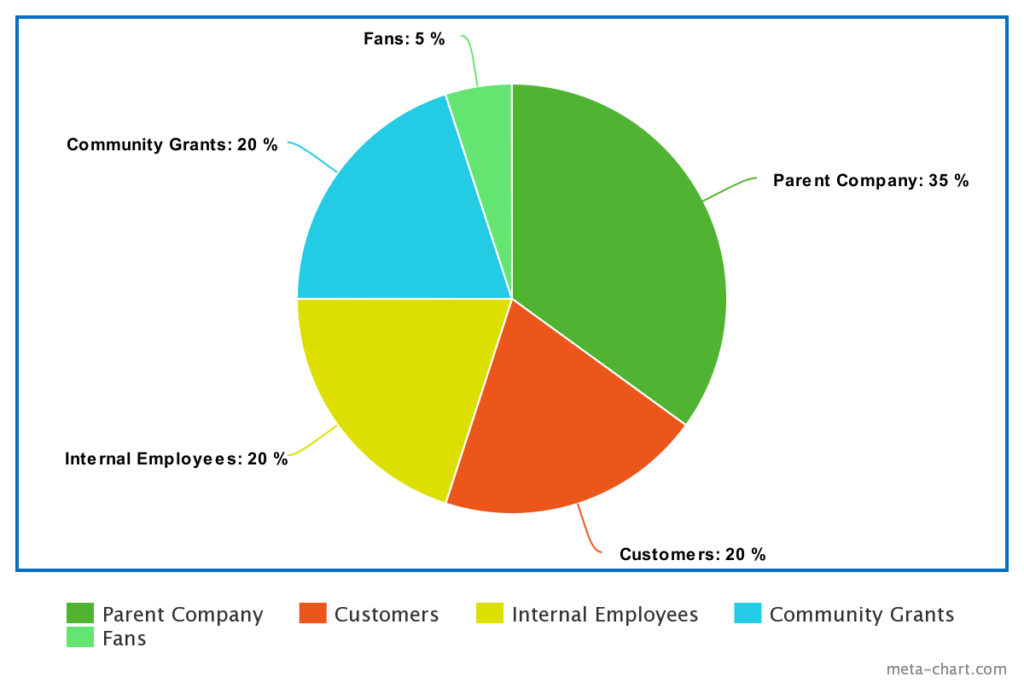

A more likely scenario is one where the parent company has the biggest piece of the pie but not a majority. So that might look like this:

This DAO structure could make the most sense for managing a skunkworks or innovation lab, which are tasked with designing, creating, experimenting, and launching new concepts. It’s certainly not limited to that but these groups are already the most self-contained and autonomous in the innovation ecosystem.

How Would a DAO Structure Affect Corporate Innovation and Its Problems?

Solves the Innovator’s Dilemma

For the uninitiated, the innovator’s dilemma is a term coined by Clayton Christensen which describes how contrary to popular belief, large companies are often the first to spot new disruptive technologies but are unable to value them properly because of the value of their existing business. A classic example is Kodak inventing the digital camera but deciding it wasn’t worth commercializing. There are countless other examples – one of my favorites is AT&T hiring McKinsey in the early 1980s to analyze the potential mobile phone market, and deciding not to pursue it after McKinsey told them the market size would be a total of 900,000 devices.

The reason the innovator’s dilemma is so difficult to solve is any innovation group under the control of a large company will be overpowered by the size of the existing business. Delivering $10 million of revenue as a startup is very impressive but delivering $10 million in the context of a company doing $50 billion in revenue means very little. It is barely a rounding error. So the large company context makes it perfectly logical to kill projects before a technology or market matures. When you consider the situation in its full context, it’s perfectly logical for Kodak not to commercialize the digital camera.

DAOs can solve the innovator’s dilemma for the simple reason that they are not under the sole control of the parent company. Token holders are incentivized to create value for the DAO (and in turn, themselves) by creating commercially successful innovations. The parent company can vote not to commercialize but the DAO would be free to commercialize the innovation itself or sell it to another company. There would be no incentive to invent something great and then decide to bury it because it may threaten the parent company’s core business.

Open Innovation

Many large companies already engage in a practice called open innovation, which involves sharing corporate innovation needs publicly and inviting outside innovators to submit their solutions, usually in exchange for investment and prize money. Last year I started a newsletter and SaaS tool called Open Innovation Leads, where I share these opportunities with startups, investors, and innovators. While open innovation sounds great in theory, in practice, it’s difficult to achieve the desired results. The right startups for a given innovation challenge are often unaware or uninterested in these competitions. And the corporate sponsors themselves are usually not as “open” about their innovation needs as they like to tell themselves.

A DAO structure solves this – a separate entity tasked and incentivized to innovate. And what could be more aligned with the open innovation mission than a publicly accessible Discord?

Speed

One of the biggest complaints about corporate innovation is that it’s unbearably slow. Companies like to pay lip service to acting like startups but it’s simply not possible within the constraints and incentive structures of a large company. The advantage of a structure outside the full control of the company is it can truly move at a pace that is untethered from the core business. The first thing you notice when following web3 projects is the pace of change is incredible. If there’s a world that’s the mirror image of corporate innovation from a speed perspective, it’s web3. Bringing that energy to the corporate innovation world will, at a minimum, increase the experimentation cadence.

Customers Get A Seat At The Table

Your best and most loyal customers are incredibly valuable – why else do companies like United Airlines, Starbucks, Marriott, and many other top brands invest billions into their loyalty programs? For years, there has been lip service paid to the idea of innovating with customers or even sourcing innovation ideas from existing loyal customers. This has been done with varying degrees of success, but one major issue always stood out to me: what does the customer get for giving a multibillion-dollar company their next great idea? A free burger? A flight? A shoutout on social media? That doesn’t seem fair or a good use of their time.

In a DAO innovation group, customers would be included as incentivized stakeholders. If a company wanted to focus on their most loyal customers, they can give tokens to loyalty program members, in amounts that are scaled by level of loyalty (i.e., United 1K gets more tokens than United Gold). This lets customers share in the upside and incentivizes them to participate actively – they should be the first to shoot down an idea that isn’t attractive to customers, even if it makes sense in a room of MBAs sharing a PowerPoint presentation. Just as important, these loyal customers become the distribution channel for new products and services – they will not only use the new products themselves but are also incentivized to spread the word more broadly.

Incentivize Top Talent

The way corporate innovation groups are currently structured, there is little incentive to build a truly great new business. Companies are still able to internally innovate but a passionate innovator is frankly much better off pursuing their great idea externally than within a corporate innovation group. As an internal employee, their best case is that they succeed and get a promotion and a raise. More often than not, their idea will get shot down due to politics or the innovator’s dilemma and they will be frustrated by the lack of progress.

At the same time, companies have been struggling with how to incentivize internal innovators for decades. Revenue and profit sharing has been proposed in the past but hits the roadblock of messing with the corporate hierarchy. An innovation manager can’t make more money than the CEO – it’s bad optics. In recent years, the externally managed studio model has taken off, partially to solve this problem.

An externally operated DAO solves this problem by incentivizing internal innovators to succeed via tokens in the DAO. If they succeed, the tokens become more valuable. There are also opportunities to create extra payouts for token holders as a reward for “spin in” or “spin out” situations (more on this in a later blog post). And since the DAO is external to the corporation and the compensation is made in tokens, the corporate pay structure optics issue no longer exists. And innovators will finally be free to capture the value they’re creating.

Requirements and Questions

While the concept of running an innovation group as a DAO has potential, there are a few questions and concerns that need to be answered.

Any company that adopts a DAO structure for any part of their innovation program will have to be comfortable with the risk of the unknown. It’s likely that the innovation DAO would make product and launch decisions differently than the company would. This could be uncomfortable for a corporate sponsor. The corporate sponsor would have to understand and embrace the idea that the DAO would make decisions differently than the company would. This is a feature, not a bug.

Companies using the DAO innovation structure will also have to get extremely comfortable with an extreme version of open innovation – in theory, anyone could join the DAO. Yes, even competitors and their employees. So, the secrecy and NDA heavy culture that pervades most of corporate innovation would have to be stripped and replaced with a more open-source compatible culture. Obviously, this will be more acceptable to certain industries and cultures than others.

Another question is how voting would work. Which decisions get voted on by the community and which get delegated to employees and contributors? Getting community participation in DAO governance can be a struggle across the web3 ecosystem and in the context of a corporate innovation function, could be even more difficult.

One major unknown that needs to be examined further, ideally by someone with a legal background, is how intellectual property could be assigned to a DAO. If the DAO develops intellectual property and sells it back to the company or spins it out into a new company, token holders will benefit. But for that to happen, a DAO must be able to collectively own intellectual property.

Conclusion

The purpose of this post is to spark ideas and get people thinking about better ways to structure and incentivize innovation. While the DAO structure is untested in a corporate innovation context, I think it’s an experiment worth trying!

I’d love to hear your thoughts – is this something you’d like to see tried in real life? Did I miss something? Let me know on Twitter.

And if you’re a corporate innovator interested in exploring this approach, reach out to me here.